What if a single email could turn a $100 donation into $200?!

What is the Matching Gift Rate(MGR) in fundraising?

Matching Gift Rate is the percentage of donations that get matched by companies or foundations. Basically, it shows how well a nonprofit is tapping into this “bonus cash” to boost fundraising.

While the Matching Gift Rate is the go-to metric, nonprofits often track a few related numbers too. These extra insights help fine-tune strategies and make the most of every matching opportunity.

Picture this: you’re at your favorite coffee shop, ready to splurge on a caramel latte. The barista winks and says, “Buy one, get one free!” You walk out with two lattes for the price of one, feeling like you just won the caffeine lottery.

That’s exactly what a matching gift does for your donation. When your employer matches your $50 gift to a nonprofit, it’s like the universe hands that nonprofit another $50, no extra charge. Suddenly, your donation is sipping double the impact.

How to Calculate Matching Gift Rate (MGR)

Let’s take a look at some of the most valuable MGR metrics and how to calculate them:

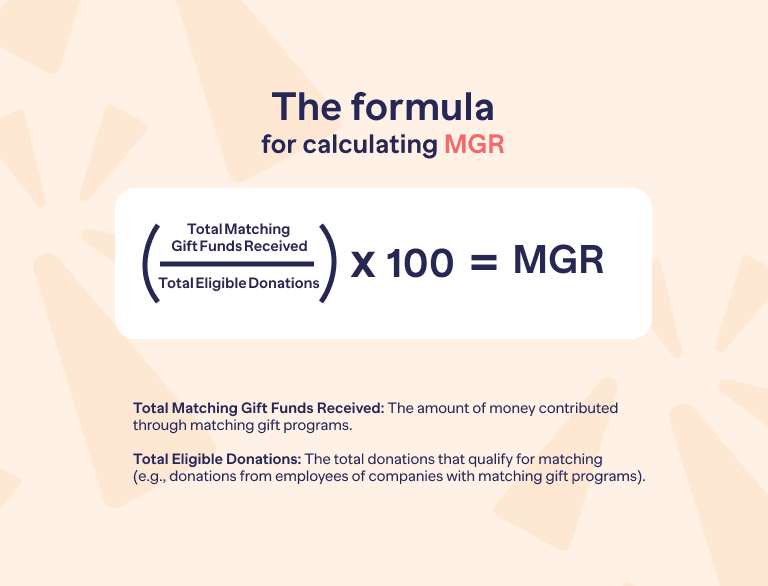

1. Matching Gift Rate (Standard)

What it is: The percentage of eligible donations that actually get matched.

How to calculate it:

Matching Gift Rate = (Total Matching Gift Funds Received / Total Eligible Donations) × 100

For example:

If a nonprofit receives $10,000 in matching gifts out of $50,000 in eligible donations, the Matching Gift Rate is:

(10,000 / 50,000) ×100=20%

This means 20% of eligible donations were successfully matched.

2. Matching Gift submission rate

What it is: The percentage of eligible donors who actually submit a match request to their employer.

How to calculate it: Matching Gift Submission Rate = (Number of Matching Gift Requests Submitted / Number of Eligible Donors) × 100

Why it matters: Reveals if low match rates are due to donors not taking action (vs. employer rejections).

Real-world Example: If 50 out of 200 eligible donors submit requests, your submission rate is 25%.

3. Matching Gift fulfillment rate

What it is: The percentage of submitted match requests that actually get paid out by companies.

How to calculate it:Matching Gift Fulfillment Rate = (Number of Fulfilled Matching Gifts / Number of Submitted Matching Gift Requests) ×100

Why it matters: Shows how many requests turn into real cash—and where things might get stuck (like rejections or paperwork hiccups).

Real-world Example: If 40 out of 50 submitted requests are approved, your fulfillment rate is 80%.

4. Matching Gift revenue contribution

What it is: The slice of your total fundraising pie that comes from matching gifts.

How to calculate it:Matching Gift Revenue Contribution = (Total Matching Gift Funds Received / Total Fundraising Revenue) × 100

Why it matters: Shows the significance of matching gifts in the overall fundraising strategy.

Real-world Example: If $10,000 in matching gifts is received out of $100,000 total revenue, the contribution is 10%.

5. Matching Gift participation rate

What it is: The percentage of all donors (not just eligible ones) who participate in a matching gift program.

How to calculate it:Matching Gift Participation Rate = (Number of Donors with Matched Gifts / Total Number of Donors) × 100

Why it matters: Shows how well you’re rallying everyone—not just corporate employees—to chase those matching dollars.

Real-world Example: If 30 out of 1,000 donors unlock matches, you’ve got a 3% participation rate.

Bottom line: This metric reveals whether you’re leaving free money on the table by not engaging your full donor squad.

6. Employer Matching Gift engagement rate

What it tracks: The percentage of companies with matching gift programs (from which donors are employed) that actually contribute matching gifts.

How to calculate it:Employer Matching Gift Engagement Rate = (Number of Companies Providing Matches / Total Number of Companies with Matching Programs) × 100

- Exposes which corporations walk the walk (not just talk the talk)

- Flags “paper program” companies that rarely pay out

- Reveals where to focus partnership nurturing

Real-world Example: If only 15 out of 50 eligible companies actually match, your engagement rate is 30% – meaning 70% need a nudge!

Bottom line: This metric turns corporate goodwill into real revenue by holding companies accountable.

Download our free step-by-step handbook with applicable methods to turn MGR data into fundraising action.

The importance of Matching Gift Rate in fundraising

This metric isn’t just about numbers. It can be your start to smarter revenue growth. Here’s why it deserves your full attention:

1. Free revenue multipliers, zero extra work

The math: A 1:1 match turns 100→200 instantly; 2:1 matches triple the impact.

Real impact:

- Doubles (or triples!) donor impact — a 50 gift becomes 100+ with a match.

- Billions go unclaimed each year — many donors don’t realize they’re eligible.

At 20% rate: 50K eligible→10K matched

At 40% rate: Same donations → $20K matched

That’s 100% more funding without new donors!!

2. Fundraising ROI on autopilot

Matching gifts deliver high returns with minimal investment—your rate reflects how efficiently you use this strategy.

Why it’s genius:

- Costs pennies compared to traditional fundraising (looking at you, 5K galas that net 20K).

- Software + smart outreach (like automated emails) can boost your rate overnight.

Example: Invest $1K in matching gift tools to bump your rate from 15% → 30%. That’s thousands more with barely any effort.

Impact: Redirect time and money from exhausting campaigns to scaling your mission.

Cost comparison:

- Traditional fundraising (events/mail): 20-50% overhead.

- Matching gifts: Minimal cost (mostly admin/software).

Smart resource allocation:

- Example: Shifting $5K from a gala to matching tools could yield higher returns.

- Software investments often pay for themselves in 90 days!

3. Strengthens donor ecosystems

Matching gifts engage donors and companies — improving your rate benefits for both. They deepen relationships with both donors and companies.

Bonus perks:

- Donors feel heroic when their gift goes further (“You turned my 50 into 100!”).

- Corporations get ESG cred for supporting you—nudge them to participate more!

- Win-win: Higher Matching Gift Rate = happier donors + stronger corporate ties.

- Pro Tip: Shout out matched donors in thank-yous (“You unlocked $X in matches!”)—it’s instant goodwill.

Donor benefits:

- 84% are more likely to donate if the match is offered.

- 1/3 would give larger amounts if matched.

Corporate synergy: 65% of Fortune 500 companies offer programs.

4. Pinpoints growth opportunities

Diagnostic power:

- Low rate? → Focus on donor education.

- High eligibility but low submission? → Simplify processes.

- High submissions but low fulfillment? → Audit corporate partners.

Pro playbook on how to shoot up your rate:

- Educate donors (many don’t know they’re eligible!).

- Embed match checks in donation forms and receipts.

- Use tools to automate matching.

- Automate eligibility screening (donation forms/thank-you emails).

- Train staff on the top 10 corporate match policies.

- Quarterly “Match Drive” campaigns.

- Publicly recognize matching donors (social/media/AR).

5. Corporate partnerships

Matching gifts are relationship-builders with companies that can unlock bigger opportunities.

Why do corporations love this?

- Over 51% of major companies (Russell 1000) offer programs.

- 48% growth in unrestricted programs.

- Top employers like Microsoft see 65% employee participation in giving.

How this helps your nonprofit? High matching rates show companies their employees care → opens doors for sponsorships.

Example: A 30% match rate with Bank of America could lead to pro bono services.

The ripple effect:

- Every matched gift proves your cause’s impact to corporate decision-makers.

- Companies track their match participation—give them wins to report.

Pro Tip: Host a “Corporate Match Challenge” where you:

- Recognize top-matching companies in your annual report

- Invite their CSR teams to volunteer days

- Share employee impact stories (“Your team matched $X, funding Y”)

Download our mini textbook with applicable methods to convert MGR data into fundraising plan.

How to Track Matching Gift Rate

To rock your matching gift tracking, you’ll need these key data points—organized and ready to roll!

Eligible donations

Pinpoint which donations qualify for matching!

Think: Gifts from awesome donors whose companies match (or special campaigns with matching pledges).

Where to find it: Donor records, employer details, or matching gift software.

Matching gift funds received

Track every dollar matched! Corporate gifts, foundation grants—all of it!

Where to find it: Financial records, match confirmations, or reports from corporate partners.

Donor & employer info

Snag those job details! Know which donors work for matching-friendly companies. Keep a database of matching gift companies—to cross-reference with donor data!

Timeframe

Pick your tracking window (monthly, quarterly, yearly—or by campaign) to ensure consistency in reporting.

Methods for tracking

Want to nail your matching gift tracking? Here’s how—pick the method that fits your nonprofit’s resources and scale!

Choose your fighter—and let’s max out those matches!

Manual tracking (DIY Style!)

How it works: Spreadsheets, donor records, and a whole lot of cross-checking donor records with employer MG policies.

Perfect for: Small but mighty orgs with tight budgets or low donation volumes.

Watch out: slow, sneaky errors happen, and scaling up? Oof.

CRM systems (Power Up!)

How it works: Tag eligible donations and track matches right inside your CRM (e.g. Salesforce, Blackbaud, NeonCRM—you name it!).

Perfect for: Mid-size to big nonprofits with significant donor bases or those prioritizing matching gift programs.

Why you’ll love it: Automates data organization, integrates with fundraising platforms, and supports reporting.

Matching gift software

How it works: Tools like 360MatchPro or HEPdata identify eligible donors, streamline matching gift submissions, and track funds received.

Perfect for: Organizations with tons of donors or those all-in on matching gifts.

Why you’ll love it: Automates eligibility checks, provides real-time tracking, and offers analytics dashboards for easy monitoring!

Corporate partnership reports

How it works: Get straight-from-the-source reports from corporate partners to confirm matching gift payments.

Perfect for: Nonprofits with established corporate connections.

Why it rocks: No guessing—just 100% accurate, verified data!

Steps to track your matching gift rate

Find your matchmakers

Ask donors for employer details during checkout (think: online forms, surveys). Use matching gift tools to instantly check if their company doubles donations!

Tag & track eligible donations

Slap a “Match Eligible” label on gifts in your CRM.

Log the amount + date—keep it clean for easy math later!

Monitor submissions

Track if donors submitted match requests to their employers.

Gentle nudge? Send a fun reminder to increase completion rates!

Calculate your matching gift rate

Matching Gift Rate = (Total Eligible Donations / Total Matched Donations) × 100

Plug & play the formula to reveal your MGR.

Show off your results!

Whip up shiny reports for your board + team.

Spot trends by comparing rates over time—knowledge is power!

Common tracking challenges (and how to solve them)

Tracking matching gifts isn’t always smooth sailing—but with the right approach, you can stay on course. Here are the most common hurdles and how to clear them:

1. Missing donor details

Problem: Donors often skip employer info, making it tough to spot eligible matches.

Fix: Embed employer fields in donation forms. Use matching gift software to auto-fill missing data.

2. Slow corporate processing

Problem: Matching payments can take months, delaying your reporting.

Fix: Track submissions (pending) separately from received funds. Use estimated timelines in progress reports.

3. Confusing eligibility rules

Problem: Every company has different rules—ratios, caps, and qualifying nonprofits.

Fix: Keep an updated matching gift policy database. Let matching gift software handle the legwork.

4. Donors don’t know they qualify

Problem: Many employees have no idea how their company matches gifts.

Fix: Add reminders in thank-you emails. Educate donors through emails, website resources, or post-donation follow-ups. Create a “Does Your Employer Match?” webpage.

5. Limited staff or budget

Problem: Small teams struggle to manage tracking manually.

Fix: Focus first on high-value donors. Try low-cost tools (simple spreadsheets). Invest in affordable matching gift tools.

Tips for the accurate calculation of Matching Gift Rate

Your Matching Gift Rate lives and dies by its denominator—Total Eligible Donations (donations that qualify for matching). Get this wrong, and your numbers go haywire! Here’s how to ace it:

Collect employer intel

Online/Offline Forms: Add a snappy field like:

“Does your employer match donations?” or

“Where do you work? (We might double your gift!)”

Follow Up: Missed details? Ping donor’s post-donation with a quick email or survey to gather missing employer data.

Tap into Matching Gift tools

Power players: Use 360MatchPro or HEPdata to instantly cross-check donors against companies with matching programs. These tools fill in missing employer details—so you never miss a match!

Know the rules

Company quirks: Some only match gifts above $25 or up to a $5,000 cap per employee annually.

Pro Tip: Keep a cheat sheet of each program’s rules (min/max amounts, nonprofit types, full-time vs. part-time eligibility).

Segment donations by campaign

Campaign-Specific Matches? No problem! Only count donations from that special campaign (like a giving day match). Use your CRM’s tags/filters to keep them separate. Easy peasy!

Technology = Automation

Manual tracking = boring and error prone. Here’s how to automate easily:

Matching Gift software

For example: Donor says where they work. Boom! Software flags it and even nudges them to submit.

CRM

Salesforce/Blackbaud/NeonCRM? Perfect! Use it to centralize donor and matching gift data.

Tag donations as “Eligible,” “Match Requested,” or “Match Received.”

Auto-generate reports—no manual spreadsheets needed!

Don’t forget the donor side!

Add a matching gift widget to your donation page or website.

Let donors check eligibility right then—more matches, less work for you! This increases the likelihood of identifying eligible donations.

Stop errors in their tracks!

Even small mistakes can throw off your Matching Gift Rate. Here’s how to keep your data clean and your reporting sharp:

Avoid double-counting

The Mistake: Accidentally adding the matched amount to the original donation (e.g., counting $100 gift + $100 match as $200 eligible).

The Fix: Only the donor’s original gift ($100) goes in the denominator. Matched funds ($100) go in the numerator.

Filter out ineligible donations

The Mistake: Marking a gift as “eligible” when the employer doesn’t match.

The Fix: Audit donor records regularly. Use matching gift software to auto-validate eligibility.

Handle refunds gracefully

The Mistake: Forgetting to remove refunded donations (and their matches) from your totals.

The Fix: Subtract refunded amounts from eligible donations. Update matching gift records to reflect cancellations.

Standardize currencies & formats

The Mistake: Mixing USD, EUR, or other currencies without converting.

The Fix: Record everything in your nonprofit’s primary currency. Use consistent exchange rates for foreign matches.

Donor Education = Better Data!

More donor awareness = more matches = higher, more accurate rates!

Promote Matching Gifts everywhere

Where to add it:

- Donation pages

- Thank-you emails

- Social media

“Psst! Your employer might DOUBLE your donation. Check if they match gifts—it takes 30 seconds!”

The more you remind donors, the more matches you’ll secure—and the truer your rate becomes. Clean data + educated donors = a Matching Gift Rate you can trust!

What is a good Matching Gift Rate in fundraising?

Wondering how your matching gift efforts stack up? Here’s the scoop—with benchmarks, real-world examples, and tips to level up!

Industry benchmarks

The Average Nonprofit: Only 1.31% of donations get matched, even though 10 %+ are eligible!

Typical Matching Gift Rate: 10-15% (if you’re doing the basics).

Why so low? Most donors don’t know they qualify!

Nonprofits with a strategy

Using automation tools + follow-up reminders? Rates jump to 15-25%.

Pro Example: One org hit 54% after persistent email nudges!

Top Performers

With killer software + corporate partnerships? 30-50 %+ is doable!

Real Win: A peer-to-peer campaign with 300 out of 560 donors landed a 53.6% rate—thanks to heavy promo.

What drives a HIGHER rate?

1. Donor awareness

Problem: Most folks don’t know their employer matches.

Fix: Shout about it everywhere—donation pages, emails, socials!

2. Donor jobs matter

Nonprofits with donors employed by corporations (e.g., tech or finance sectors)? Their companies often match dollar-for-dollar. Universities + big corps? Big wins for matches!

3. Automation

Tools like 360MatchPro ID eligible donors instantly and send reminders.

Result? More submissions, less work for you.

4. Campaign type plays a role

Peer-to-peer or giving days? Perfect for targeted matching gift pushes!

Quick benchmark cheat sheet

- Just starting? 10-15% is normal, but you can do better! (minimal promotion, manual tracking).

- Putting in effort? 15-25% is your next milestone (moderate promotion, some automation).

- All-In with tools + Hustle? 30-50 %+ is within reach! (robust promotion, automation, and follow-ups).

The Bottom Line: Even small upgrades (like adding a matching gift search tool to your website) can double your rate.

The Strategy Builder

| Challenge | Action | Impact |

|---|---|---|

| Low donor awareness | Add matching gifts prompts to donation forms, emails, and website. Embed a search tool. | 52% email open rate; 73% donor usage of search tools. |

| Incomplete donor data | Add employer fields to donation forms. Use matching gift software to auto-fill data. | Reduces missed matches; improves MGR accuracy. |

| Low submission rates | Send 1-2 follow-up emails within 24 hours of donation. | 31% submissions with 1 email; 45% more with 2. |

| Low fulfillment rates | Auditing corporate partner policies. Simplify submission processes. | Increase payout rates (e.g., 80% fulfillment). |

| Manual tracking | Invest in CRM or matching gift software. | Cuts errors; boosts efficiency. |

| Weak corporate partnerships | Host a “Corporate Match Challenge” and recognize matching companies. | Engages 51% of Russell 1000 companies with programs. |

| Limited staff/budget | Focus on high-value donors. Use low-cost tools like spreadsheets initially. | Maximizes ROI with minimal resources. |

Matching Gift Rate Growth Benchmarks

Want to turn matching gifts into a capital revenue stream? Here’s your step-by-step guide—with realistic targets, proven strategies, and real-world examples to scale your impact!

Benchmark your growth

1. Baseline assessment

Action: Calculate your current Matching Gift Rate.

Example: 5Kmatched÷50K eligible = 10% rate

2. Growth goal:

Basic programs: Aim for +5-10% annually.

Investing in tools? Target +10-20% yearly!

Short-Term growth (6–12 Months)

Target: Boost your rate by 5-15% within the first year of implementing new strategies.

How?

- Educate donors: Add matching gift prompts to donation forms + confirmation emails + thank-you pages. (Did you know? 1 follow-up email = 31% submissions; 2 emails = +45% more!)

- Embed a search tool on your donation page (73% of donors use these if available!).

- Automate with software (Potential engagement boost: 75%!)

For example: A nonprofit with a 10% rate could aim for 15-20% by implementing email reminders and a search tool, increasing matched funds from $5,000 to $7,500-$10,000 for the same $50,000 in eligible donations.

Medium-Term growth (1–3 Years)

Target: Matching Gift Rate of 20-30% for organizations starting with basic programs, or 40-50% for those with active programs.

How?

- Go multichannel: Matching gift emails have a 52% open rate (2.6x the nonprofit average) and a 7% click-through rate (2.4x the average).

- Corporate partnerships: 51% of Russell 1000 companies publicly disclose matching gift programs, and this number is growing—tap in!

- Segment high-potential donors: Target employees at match-heavy companies

For example: A nonprofit at 15% could aim for 25-30% by year three, increasing matched funds to $12,500-$15,000 for $50,000 in eligible donations.

Long-Term leap (3–5 Years)

Target: Reach a Matching Gift Rate of 40-60% for top-performing organizations.

How?

- Optimize follow-ups: Send multiple reminder emails (e.g., three emails can increase submissions to 54% of eligible gifts).

- Integrate with fundraising platforms and embed matching gift prompts in peer-to-peer campaigns, where 100% of top peer-to-peer nonprofits incorporate matching gifts.

- Track retention: Monitor the Matching Gift Retention Rate (percentage of donors repeating matches year-over-year).

For example: A nonprofit at 20% could aim at 40-50%, increasing matched funds to $20,000-$25,000 for $50,000 in eligible donations.

Aspirational goals

Achieve rates comparable to top-quartile programs, where 75% engagement (including interactions with search tools, forms, or emails) is possible.

How?

- Compare your rate to industry standards (10-15% = basic; 15-25% = active).

- Invest in tools: Automate to cut missed opportunities ($4–7B in matches go unclaimed yearly!).

- Relentless promotion.

- Corporate partnerships + peer-to-peer campaigns.

For example: For $50,000 in eligible donations, a top-tier program could secure $30,000-$37,500 in matched funds, yielding a 60-75% rate.

Industry benchmarking reports

Soon you’ll be able to start tracking Matching Gift Rate (MGR) with RallyUp

Exciting news for fundraisers and corporate social responsibility (CSR) teams! RallyUp is expanding its feature set with an addition: built-in donation matching tracking (coming soon!)

For CSR fundraisers specifically, this upcoming “Built-in Donation Matching” feature will automatically calculate and display the doubled impact of matched donations.

The beauty of this system is that RallyUp handles all the tracking and management of matched donations. You’ll have complete control over the parameters, with options to:

- Set specific timeframes for matching periods

- Establish maximum matching amounts

- Or implement both limitations together

Stay tuned as RallyUp continues to enhance its platform with features designed specifically for corporate giving and CSR initiatives!

Think you know how matching gift rates can double (or triple!) your donations?

Think you know how matching gift rates can double (or triple!) your donations? Take this quick 7-question quiz to test your knowledge of matching gift rates and learn how to maximize your fundraising impact. Let’s see if you’re a rate-savvy fundraiser!

Your frequently asked Matching Gift Rate questions answered

A low rate may result from:

• Low donor awareness

• Incomplete data

• Delayed submissions

• Limited promotion

You need:

• Eligible donations

• Matching Gift Funds received

• Donor Employment Data

• Timeframe

• Tools like CRMs or matching gift software

Donor awareness is critical, as only 1 in 3 donors know their donation could be matched. Low awareness leads to fewer match submissions, lowering the rate. To boost awareness:

Include matching gift prompts in donation forms and confirmation emails (52% email open rate for matching gift appeals).

Add a matching gift search tool to your website (93% of top peer-to-peer nonprofits have dedicated pages).

Matching gift funds can take weeks to months to process, depending on the company’s program (e.g., 30-90 days for approval and payment). This delay can underreport the rate if tracking is time-bound.

Misidentifying eligible donations: Including ineligible donations or missing eligible ones due to incomplete employer data.

Double-counting funds: Counting matching gifts as part of eligible donations, inflating the denominator.

Inconsistent timeframes: Mixing donations and matches from different periods.

Ignoring partial matches: Not accounting for caps or ratios (e.g., a $1,000 donation matched only up to $500).

The rate varies based on:

• Campaign type: Peer-to-peer or event-based campaigns often have higher rates (e.g., 53.6% in some peer-to-peer campaigns) due to targeted promotion.

• Donor demographics: Nonprofits with corporate employees see higher rates due to prevalent matching programs.

• Nonprofit size: Larger organizations with robust tools achieve 20-50%, while smaller ones may hit 10-15%.

• Sector: Education and health nonprofits often have higher rates due to strong corporate ties.

• Donation forms: Add employer fields and matching gift prompts (93% of top nonprofits have • dedicated pages).

• Emails: Send reminders within 24 hours of a donation (53% open rate) and follow up multiple times (second email boosts submissions by 45%).

• Website: Embed a matching gift search tool (73% donor usage).

• Events: Promote matching gifts during campaigns or giving days (100% of top peer-to-peer nonprofits integrate matching gifts).

Not enough people know about this fundraising potential. It’s like leaving free money on the table at a buffet—tragic! By boosting your matching gifts rate, nonprofits can turn a good fundraising day into a great one, all because you took 30 seconds to check if your company plays the matching game.

Pop over to your HR portal or shoot a quick email to check if your employer offers matching gifts! It’s easier than untangling your earbuds.

Found a match? Share this article with a friend and spread the word about this donation-doubling hack!

If you enjoyed this article, you might also like:

- 42 Fundraising KPIs and Metrics Everyone Should Measure

- Calculating the return on investment (ROI) in fundraising

- What is the Gifts Secured Metric in fundraising? How to calculate and use GSM

- What is the conversion rate? How to calculate and use conversion rate

- What is Pledge Fulfillment Percentage in fundraising? How to calculate and use PFP?