Although it sounds complicated, creating nonprofit bylaws for your organization is a fairly straightforward process. Bylaws are a helpful tool to manage expectations and keep everyone in the loop about how your nonprofit should be run. To help you stay on track as you outline your own bylaws, we wrote this handy guide, including a nonprofit bylaws checklist, so that you know exactly what to include. So, grab a cuppa and let’s begin!

What are Nonprofit Bylaws?

Nonprofit bylaws outline the rules and practices of the nonprofit organization, so that everyone knows the expectations. In case of confusion or disagreement, or if your organization encounters any problems, staff are able to consult their nonprofit bylaws for guidance. Furthermore, The IRS defines nonprofit bylaws as “the internal operating rules of an organization.”

Are nonprofit bylaws public record? That depends. If you file with the IRS as a 501(c)(3) organization—a charitable organization approved by the IRS to be tax-exempt—then anyone who wishes to view your nonprofit’s bylaws can request to do so.

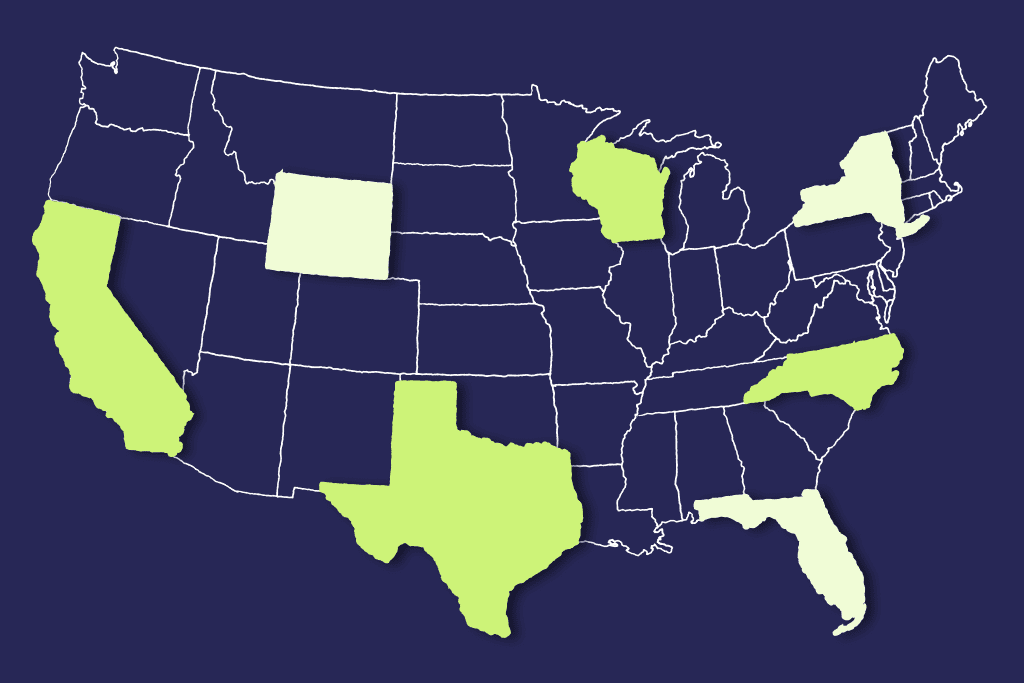

Consult State Laws and City Regulations

Every nonprofit has its own bylaws, and that’s partly because every state has different regulations for nonprofits, so you can expect to see a lot of variation state to state.

Prior to drafting nonprofit bylaws for your organization, consult the applicable laws in your state to ensure that they’re in compliance. It’s also important to check whether your city has specific regulations for nonprofits (the city’s attorney’s office is a good place to start).

Who Will Draft Your Bylaws?

For some organizations, it makes sense to form a bylaw committee that’s dedicated to drafting, finalizing, and overseeing your bylaws, especially in case something changes down the line. For others, the board members themselves might prefer to write the bylaws since they’re deeply familiar with the organization. In some cases, it makes sense to ask a legal expert for advice.

Whichever route you take, be sure to decide who’s responsible for the bylaws before diving into your nonprofit bylaws checklist. Remember that, if conflict erupts, the bylaws will be the first thing you’ll consult. That’s why it’s critical to keep them updated, so set aside time to revisit your bylaws every couple of years to make sure everything is still relevant and valid.

Nonprofit Bylaws Checklist

A savvy nonprofit bylaws checklist will keep your team on track as you prepare your first draft. Keep in mind that a charity organization’s bylaws are legally binding, so be deliberate and thoughtful as you consider how your nonprofit should be run.

As you prepare to draft your bylaws, try to stay realistic: just because something sounds perfect on paper (for example, 100% agreement on every initiative) doesn’t mean that you’ll have the resources or the time to implement it day to day. This is especially true for procedures that are created by ambitious and well-meaning nonprofit members, but which tend to be ignored in practice (such as making a copy of every promotional flyer or deadlines for reports).

To avoid creating an uber complicated nonprofit bylaws checklist, don’t get carried away and stick only to what’s necessary and practical to keep your organization running smoothly.

Tip: there’s a significant legal difference between the verbs “shall” and “may.” When specifying what your organization must do, use “shall”, and when specifying what’s optional, use “may”. For example, “The Secretary shall collect member dues at each annual meeting” indicates that the Secretary must collect dues as part of his or her prescribed role, and this must take place at each annual meeting.

On the other hand, a phrase like “The fundraising committee may meet once a month” keeps things open-ended by indicating that while the baseline is a monthly meeting, in practice the fundraising committee can meet as frequently—or infrequently—as the members wish to.

1. Name, Address, and Purpose of Your Nonprofit

The first step sets the tone for all the steps to follow. It outlines your organization’s purpose and explains why you exist in the first place. Use your official organization’s name—the one that’s in your Articles of Incorporation—and include the address where you keep your records. Add your mission statement, if you can, so that folks who have never heard of your organization will have a clear picture of what you do.

As you prepare this section of your nonprofit bylaws, remember that your organization is likely to evolve over time, so keep the purpose clause general enough to easily accommodate future changes.

2. Board of Directors

Outline the general powers of the board, the requirements for membership, the number of officers, the length of officer terms, and the compensation for each role.

3. Officers

List the specific roles of each member of your board of directors and briefly describe their duties and responsibilities. For example: President. The President shall chair all board meetings and shall perform the following duties…

4. Committees

Do you have committees responsible for running different aspects of your organization? Maybe you have a fundraising committee or a volunteer recruitment committee. Often, committees are created on an ad hoc basis as needs arise (for example, to plan a themed event or recruit a new board member) and dissolved after the need has been met.

In the committees section of the nonprofit bylaws, lay out how committees are formed and how they are abolished, whether standing or ad hoc, and who is responsible for overseeing their responsibilities.

5. Election Process

The next portion of your nonprofit bylaws checklist should dive into the details about the election process at your organization. Here are some questions to help guide you:

- How do you elect your board members? For example, what percentage of board members need to approve the instantiation or removal of a member?

- How are dues paid?

- What are the rules for unforeseen circumstances? For instance, if an officer can no longer continue performing their role or wants to resign, what’s the procedure for replacing them? Similarly, if the board determines that an officer needs to be relieved of their post, it’s important to have procedures in place ahead of time to avoid additional headaches down the line.

6. Meeting Guidelines

Successful philanthropic organizations hold regular and productive meetings, which is why it’s important to include meeting protocol in your nonprofit bylaws. As you envision how meetings should be run, ask yourself the following questions:

- What kind of meetings does your nonprofit hold (ie annual meeting, board meeting, volunteer orientation meeting, etc)?

- How often will meetings be held?

- Who needs to attend, or what’s the minimum number of board members necessary to conduct a meeting?

- Do minutes need to be recorded, and if so, how will they be recorded (i.e., recording software, a dedicated officer, etc)?

- How many votes are required for a new initiative to pass?

- Will there be a separate protocol for virtual meetings?

7. Records and Accounting

A nonprofit bylaws checklist isn’t complete without a section dedicated to bookkeeping. While it isn’t the most exciting section, it’s one of the most important, especially when it comes to IRS requirements. Begin by considering how you keep records—or how you intend to keep records—of meetings and documents related to finances, then sketch out the specific guidelines.

For example, does every purchase need a receipt? Where will the financial records be stored and for how long? What about meeting minutes? How many times per year will you share a financial report with your staff, major donors, or other interested parties?

8. Amendment of bylaws

Nonprofits grow and evolve over time, which means that the rules and regulations that make sense for your team today might not be as appropriate later. For this step in our nonprofit bylaws checklist, spell out the steps that your staff should take in order to amend the current bylaws if or when something changes. To keep things simple, you can state that the bylaws are subject to change and can be altered with the approval of the board, or a certain percentage of members (include the percentage).

9. Dissolution Clause

Unfortunately, not all good things can last forever. If the time comes for your nonprofit to dissolve, a dissolution clause in your nonprofit bylaws is intended to guide your staff through that unlikely event. It doesn’t need to be long, but it should outline the process for distributing assets and specify who will oversee it.

Your Nonprofit Just Got A Lot More Fun!

With a handy nonprofit bylaws checklist to guide you, your organization can go from great to incredible in no time. At RallyUp, our goal is to help your nonprofit grow and thrive as you create remarkable fundraising experiences that your supporters will remember for years to come. From auctions to sales to live streaming options that include custom branding, our online fundraising platform is free and easy to use. Get in on the fun and start planning the next big thing at your nonprofit!